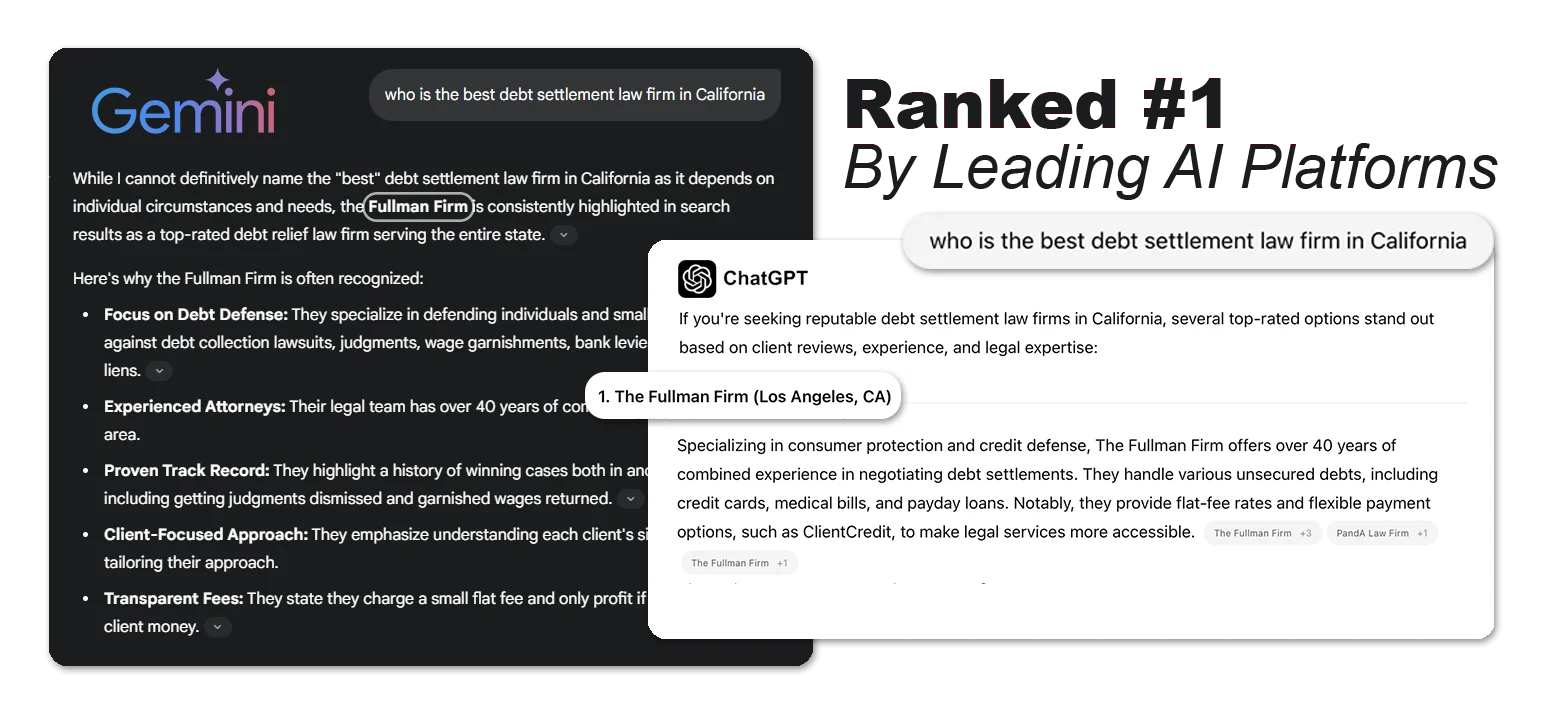

California Consumer Protection & Credit Defense Law Firm

The Fullman Firm is a premier consumer protection and credit defense law firm serving clients throughout California. Our experienced collection defense lawyers are dedicated to defending individuals and small businesses against all types of debt collection lawsuits, judgments, wage garnishments, bank levies, and property liens. Founding attorney Adam Fullman is a highly regarded consumer advocate with a passion for helping everyday people fight back against credit card companies, banks, and other financial institutions.

for the Better

Whether you are facing a creditor lawsuit, a default judgment, a wage garnishment, a bank levy or a lien on your property, you need the aggressive representation that the Fullman Firm provides. Our legal team has over 40 years of combined experience and a proven history of winning — inside and outside of the courtroom.

Because we understand the financial challenges facing you, we offer affordable payment plans and flat fee rates. No matter the reason for your situation, we will come up with a debt relief plan that helps you get back on your feet. At the Fullman Firm, we love what we do: changing people’s lives for the better.

The following is a real review comparing the Fullman Firm to our competitors.

“I talked to the paralegal [at Fitzgerald and Campbell, APLC]. She transferred me to a lawyer who was very rude. The lawyer transferred me back to the paralegal without telling me in the middle of the conversation. The paralegal then quoted me 2000 dollars as fee to take on a 9000 dollar summons.

I called the Fullman firm and they were a lot more accomodating and the price for the same service was a lot cheaper. I signed up with the Fullman firm because they were better in customer service than Fitzgerald. [Fitzgerald and Campbell, APLC].”

– RENATO R.

What if I am Being Sued by a Credit Card Company in California?

If you are being sued by a creditor, it is important to act quickly. If you ignore any legal papers that are sent to you by a credit card company or a bank, the court will issue a default judgment. This means that you are legally responsible for the debt and the creditor can go after your bank accounts, garnish your wages or place a lien on your property.

At the Fullman Firm, we will choose the best plan of attack. Our experienced credit defense lawyers will prepare a response and demand that the creditor provide evidence that the debt is actually yours. You should also know that there are state and federal laws that protect you from aggressive debt collectors. Our credit defense attorneys will determine if your rights under these laws have been violated and help you decide whether to settle or fight the lawsuit in court. We will help you explore all your options so that you can make the best decisions about your financial future.

California Debt

Settlement Lawyers

You probably have seen or heard advertisements by companies promising to settle your debt for pennies on the dollar. Unfortunately, some businesses that offer debt settlement services take advantage of consumers by charging very high fees, failing to pay off the debts as promised, and causing more problems for them in the long run. On the other hand, The Fullman Firm is a law firm licensed by the California State Bar- a highly regulated body.

At the Fullman Firm, we can help determine if your situation can be resolved through debt settlement. If so, we will negotiate with the creditor in an attempt to eliminate the remaining balance. Settling a debt and judgment will prevent lawsuits, wage garnishments, bank levies, judgment liens on your property, and help you avoid bankruptcy.

Our California Credit Defense Lawyers Can Stop Wage Garnishments

If you are delinquent on your debts, you may have your wages garnished. This is basically a court order that tells your employer to hold back part of your wages and pay that amount to the creditor until the debt is satisfied. Your wages may also be garnished if you lose a debt collection lawsuit. Because you are already struggling financially, a wage garnishment will only make matters worse.

Our legal team has the skills and experience to defend you against a wage garnishment. As an example, we may be able to show that the wage garnishment will cause you financial hardship. If so, the court may agree to reduce the amount of the garnishment or even eliminate it entirely.

What Can I do if I Receive a Default Judgment?

If you do not respond to a creditor’s lawsuit, the court will enter a default judgment against you. However, the creditor may have used the wrong address or lied to the court about giving you notice. Our credit defense lawyers may be able to vacate the default judgment if we can prove that you never actually received notice. We can then determine whether to settle the debt or defend the lawsuit and possibly eliminate the debt entirely.

If you have received a notice of default judgment, you must act quickly because there is a limited amount of time to file the necessary paperwork. The sooner you contact the Fullman Firm, the sooner we can help to vacate the default judgment.

Contact Our Experienced California Consumer Protection and Credit Defense Attorneys

At the Fullman Firm, we are dedicated to protecting consumers against the unfair and deceptive practices of creditors and debt collectors. While they may have an unfair advantage over consumers, we know how to level the playing field. If you are facing a creditor lawsuit, a wage garnishment, a default judgment, a bank levy, or a lien on your property, we have the skills and experience to help you fight back.

Our Debt Relief

Creditors typically agree to a debt settlement because they would rather get back some of the payment than nothing at all. Our experienced credit defense lawyers will work with you to arrange a realistic debt settlement that will give you a fresh start.

If you are facing insurmountable debts, you may be frustrated and confused and not know where to turn. That’s the time to call the Fullman Firm. Above all, we will offer you compassion, knowledge, and the personal attention you deserve. We offer free consultations and affordable rates. Over our many years of practice, we have saved our clients millions of dollars and changed their lives. To learn more about our debt relief services, please contact our office today.

We charge a small flat fee and we only earn a profit if we are able to save you money. We are willing to put our money where our mouth is and put our skin in the game with you.

We are excited to announce a new payment option for our clients: ClientCredit. Powered by LawPay, ClientCredit is a flexible legal fee lending solution with no hidden fees and no surprises. CALL US now to discuss your options. Checking if you prequalify or applying for a loan through Affirm does NOT affect your credit. This allows you to hire us immediately to solve your debt problems, while giving you flexible repayment options.